CTA’s 101: How to make money with trend-following?

- The Delta House

- Apr 18, 2025

- 1 min read

How trend-following CTA’s (managed futures funds) make money

It’s not exactly what you think if you aren’t involved in the day-to-day management of these strategies. Here’s a quick rundown of the factors that produce the P&L of a typical medium-to-long-term trend-follower.

1. Return on collateral: CTA’s operate on leverage using futures (& forward FX contracts) so they have a set margin-to-equity that determines how much they need to put-up as collateral to run their positions and have cash leftover for drawdowns. Let’s make a conservative estimate that they invest 50% of the cash at the prevailing 91-day T-bill rate.

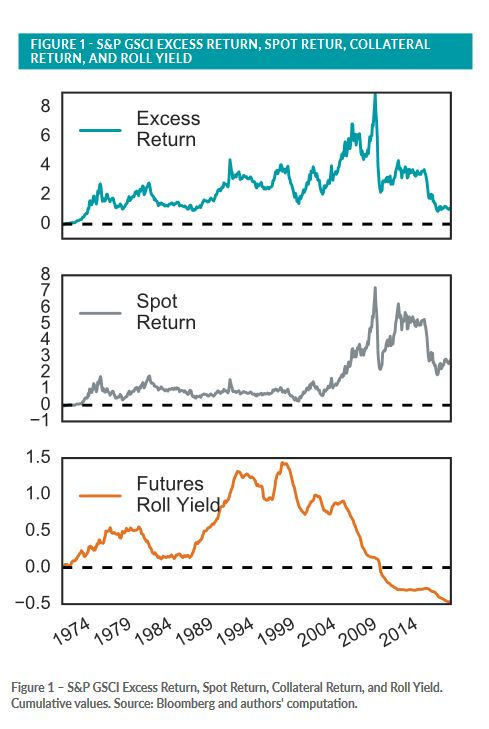

2. Implied Spot Return: Since the majority of CTA’s operate in the listed derivatives space, not the cash/spot space, they can’t generate spot returns directly. They generate the return implicitly by subtracting out the roll-yield from the return to realize their implied spot return.

3. Roll-Yield: Futures & forward contracts are not continuous; they are discrete and have expiration dates ranging from monthly (energy) to quarterly (stock indexes). As such, those contracts need to be rolled and the futures curve is constantly oscillating between backwardation (spot month higher than forward months) & contango (spot month lower than forward moths). This roll-yield is the primary P&L driver for CTA’s. Roll-yield is a tailwind during backwardation, and a headwind during contango.

That’s the quick & dirty of how a CTA generates returns. We follow CTA flows at The Delta House and use them to create a trading edge.

Check us out!

Comments